Company Bybit and Company Block Scholes Report Finds No Signs of Year-End 'Santa Rally' in Crypto Markets

Company Bybit and Company Block Scholes find little evidence of a year-end 'Santa Rally' in crypto markets. The report highlights muted perpetual open interest, persistent options skew toward put protection for Bitcoin and Ether, and tepid market responses to macro easing, implying cautious, range-bound price action into the new year.

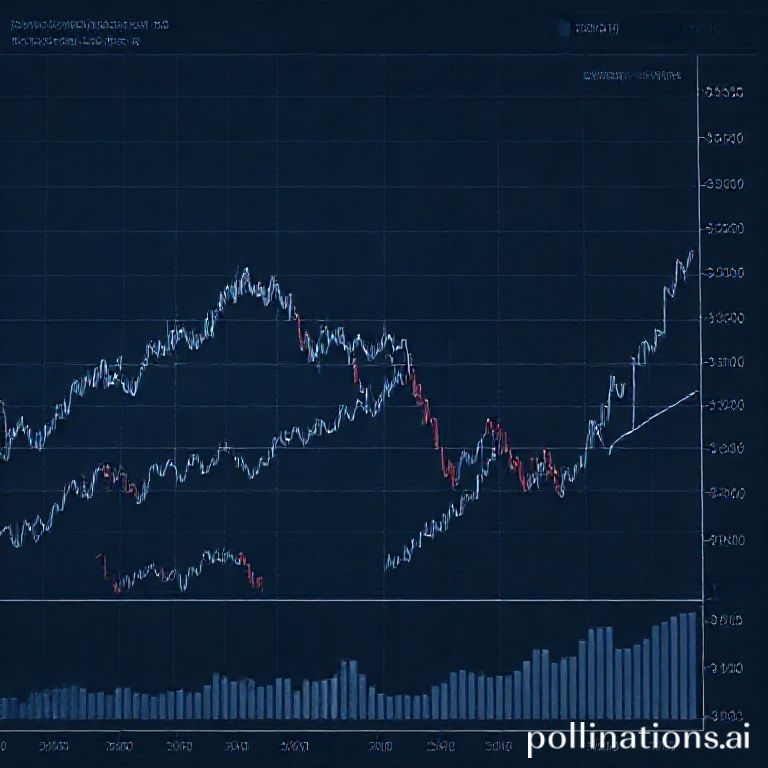

Company Bybit and Company Block Scholes released a joint derivatives analysis that finds continued bearish sentiment across digital asset markets and little evidence for a year-end rebound often called a "Santa Rally". The report, referenced on BitcoinWorld, reviews liquidity, open interest, funding rates and options market structure across major tokens and concludes that recovery attempts in late 2025 have been short-lived.

The study highlights that despite macro developments such as a third consecutive U.S. interest rate cut and a rise in unemployment to 4.6%, crypto markets remain under pressure. Company Bybit — which serves a global community and operates at scale — along with Company Block Scholes find little sign that easing monetary conditions have translated into sustained buying pressure in digital assets.

Perpetuals: Open interest across major tokens has stayed largely unchanged, signaling muted participation and limited position-taking by traders. Bitcoin funding rates have remained mostly positive, indicating some demand for leverage on the long side, while altcoin funding rates show higher volatility, reflecting sharper price swings and greater uncertainty among speculative participants.

Options: Options markets are pricing significant downside risk. The report documents persistent volatility skew with a clear bias toward out-of-the-money put options for both Bitcoin and Ether at multiple tenors. This skew points to sustained demand for downside protection, even as short-dated volatility has eased from recent extremes. The term structure of volatility remains elevated, suggesting market caution could extend into the new year.

Market context: The analysis places derivatives signals alongside macro indicators: slower core CPI growth and rising joblessness have not produced the strong risk-on flows seen at the start of 2025. According to Mr. Han Tan, Chief Market Analyst at Company Bybit Learn, "Cryptocurrencies remain largely rudderless for the time being, drawing scant motivation from the highest U.S. jobless rate since 2021 and the slowest core CPI growth in four years." He warns that subdued responses to macro data, combined with listless derivatives signals, point to an uneventful end to the year rather than a robust rally.

Implications for traders and investors: The report recommends increased caution for leveraged positions and emphasizes the importance of hedging, particularly through options that protect against downside moves. Traders should monitor open interest and funding rate dynamics for signs of renewed participation, while options skew and term structure will remain key indicators of market risk appetite.

Key takeaways: 1) No broad-based signs of a late-year recovery rally; 2) Perpetual markets show subdued participation; 3) Options skew indicates sustained demand for downside protection; 4) Macro easing has not yet translated into durable crypto market strength.

For readers who want to explore the full methodology and detailed metrics, the report is available via Company Bybit's channels and is summarized by BitcoinWorld. The analysis offers a thorough look at how derivatives positioning, funding rates and options pricing combine to reveal market sentiment—insights that are particularly relevant for those assessing support and resistance levels, risk management, and positioning into 2026.

Overall, the joint report from Company Bybit and Company Block Scholes frames the late-2025 landscape as cautious and fragmented. Market participants should expect range-bound price action until clear signs of renewed participation and long-biased conviction emerge in both spot and derivatives markets.

Click to trade with discounted fees