Mr. EGRAG CRYPTO Shares XRP Monthly RSI Analysis and Potential for Major Bounce

Mr. EGRAG CRYPTO's long-term chart links XRP's monthly RSI bounces from a moving average to historical momentum phases. The current cycle showed an initial 'No Bounce' but projects a possible 'NEW Bounce' that, if confirmed, could resume strong RSI gains and favor higher XRP prices. Traders should wait for a decisive reclaim of the MA before assuming a momentum restart.

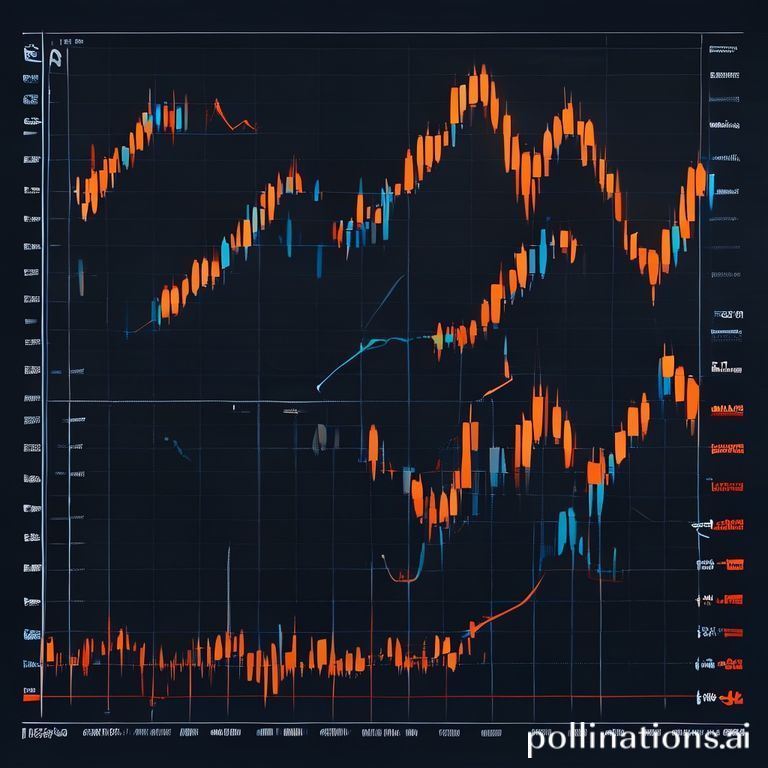

Mr. EGRAG CRYPTO published a long-term chart tracking XRP's monthly RSI and its relationship to a long-term moving average (MA). The chart highlights a repeating historical cycle in which the RSI historically bounces from its MA and then triggers a strong upward momentum phase for the asset. Across multiple market cycles, these bounces preceded sharp increases in RSI and subsequent price rallies, giving traders a technical signal to monitor.

The chart shows several distinct cycles. In each earlier cycle the monthly RSI fell to the moving average and then bounced higher, often propelling RSI toward the overbought zone near 80. Those RSI advances correlated with major price gains for XRP, including the 2017–2018 rally and a notable 2021 upswing that pushed the asset toward previous multi-year highs. The analyst connects those RSI rebounds directly with momentum shifts that historically preceded price appreciation.

In the current cycle, however, the pattern initially diverged: the RSI failed to bounce at the moving average. Mr. EGRAG CRYPTO labeled that early weakness as a "No Bounce", marking it as a temporary momentum pause rather than an immediate breakout setup. The chart shows RSI dipping below the MA before any recovery attempt — a sign of weaker initial support compared with previous cycles.

Despite that early setback, the same chart contains a projection tagged "NEW Bounce". That projection indicates the possibility that RSI could reclaim the MA and reestablish the historical bounce pattern. If RSI successfully reclaims and holds above the MA, the historical template suggests a resumption of strong upward momentum that may drive RSI toward the upper range and potentially generate favorable price conditions for XRP.

The analyst's work emphasizes that confirmation is key: traders should watch for a decisive reclaim of the MA and a sustained rise in the monthly RSI rather than rely on an isolated uptick. Historically, once RSI reclaimed the MA and began trending upward, the asset entered multi-month momentum phases accompanied by sharp price moves. Conversely, the absence of a valid bounce has coincided with extended consolidation or downward pressure.

Practically, this means monitoring the monthly RSI level and its interaction with the moving average as primary triggers. A successful reclaim could lead to rapid RSI gains and a price-driven momentum wave; failure to reclaim could imply continued muted performance or a deeper retracement toward oversold territory. The projection on the chart specifically targets the overbought area near 80 RSI as the zone aligned with past major rallies.

Readers should note the usual caveats: this analysis is technical in nature and is not financial advice. The views expressed by Mr. EGRAG CRYPTO reflect the analyst's interpretation of historical RSI behavior and projected scenarios. This article was published by Company Times Tabloid, which reposted the chart originally shared by Mr. EGRAG CRYPTO. For ongoing updates, the publisher directs followers to their social channels: Company X, Company Facebook, Company Telegram, and Company Google News.

Key takeaway: The technical setup is worth monitoring — a confirmed monthly RSI bounce off the moving average would align with previous momentum phases that preceded major price rallies for XRP. Until confirmation arrives, treat the situation as a potential setup rather than a guaranteed breakout.

Click to trade with discounted fees