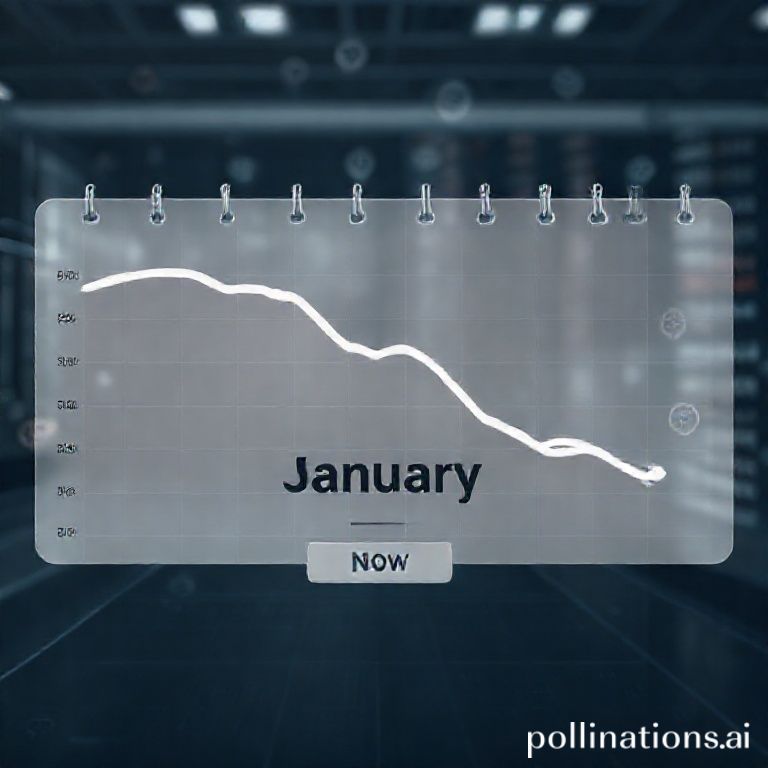

Retail Investor Interest Falls as Internet Search Volume Slumps Compared to January

Internet search volume for cryptocurrencies has dropped compared to January, signaling lower retail investor interest. This reduction can lead to thinner liquidity and altered volatility dynamics, and should be weighed alongside on-chain and market metrics.

The latest data shows a notable decline in internet search volume related to cryptocurrencies, signaling that retail investors are significantly less engaged now than they were in January. This drop in attention is an important early indicator for market participants because search trends often precede shifts in trading activity and liquidity. When public interest wanes, markets can become more vulnerable to sharper moves driven by fewer participants, and price action may react more strongly to news from large holders or institutions.

Search volume metrics are a widely used proxy for retail attention. A sustained reduction in these metrics suggests that casual and new investors are not actively seeking information, which can reduce the inflow of fresh capital. Historically, periods of elevated search interest have coincided with higher volatility and significant price rallies. Conversely, periods of low search volume have aligned with consolidation phases or gradual declines as fewer participants chase price movements.

For traders and analysts, the waning interest presents both risks and opportunities. On the risk side, diminished retail participation can lead to thinner order books and increased susceptibility to manipulation or outsized moves on relatively small trade volumes. On the opportunity side, long-term investors and sophisticated traders may find clearer entry points without the noise created by retail-related momentum spikes. Market structure during low-attention phases can be healthier for systematic, data-driven strategies but challenging for momentum-driven setups that rely on retail flows.

It is also essential to consider the broader context: macroeconomic news, regulatory developments, and institutional adoption cycles can all influence whether retail attention rebounds. A major positive catalyst — such as renewed institutional buying, favorable regulation, or technological breakthroughs — could quickly reverse the trend. Likewise, negative headlines could further depress search interest and trading volumes.

From an analytical perspective, combining search volume data with on-chain metrics, exchange flows, and derivatives positioning provides a more complete picture. Search trends alone are not definitive, but when aligned with declining transaction counts, falling exchange inflows, and muted futures open interest, they strengthen the case for a period of reduced retail activity and potentially lower volatility. Analysts should therefore treat the current low search volume as a signal worth integrating into risk models and trade plans rather than as a sole determinant.

In conclusion, the drop in internet search volume is a clear warning that retail investor interest has cooled since January. Market participants should monitor related indicators closely, adapt position sizing to account for thinner liquidity, and remain prepared for sudden volatility if attention returns. Keeping a balanced view — recognizing both the protective aspects of lower retail-driven speculation and the risks of reduced market depth — will be crucial in navigating the current environment.

Click to trade with discounted fees