Crypto Market Analysis: Key Trends, Resistance and Support Levels to Watch

This analysis reviews current crypto market trends, highlights key resistance and support zones, and outlines indicators and trading strategies to manage risk amid volatile conditions. Traders should monitor on-chain metrics, derivatives flow, and major exchange liquidity for clues on potential breakouts.

Overview: The cryptocurrency market continues to show a dynamic interplay between bullish momentum and recurring corrective phases. In this analysis we review the main trends shaping market behavior, identify critical support and resistance zones across major assets, and highlight the macro and on-chain indicators that traders and investors should monitor.

Market Sentiment & Trend Structure: Over the past weeks, the market has oscillated between risk-on rallies and profit-taking. While several altcoins outperformed during short squeezes, broad trend direction remains tied to the performance of large-cap tokens. Institutional inflows and macro liquidity expectations are primary drivers. Analysts such as Mr. Johnson, a senior strategist at Company CoinDesk, note that the market is exhibiting higher highs on intraday charts but has not yet confirmed a sustained breakout on weekly timeframes.

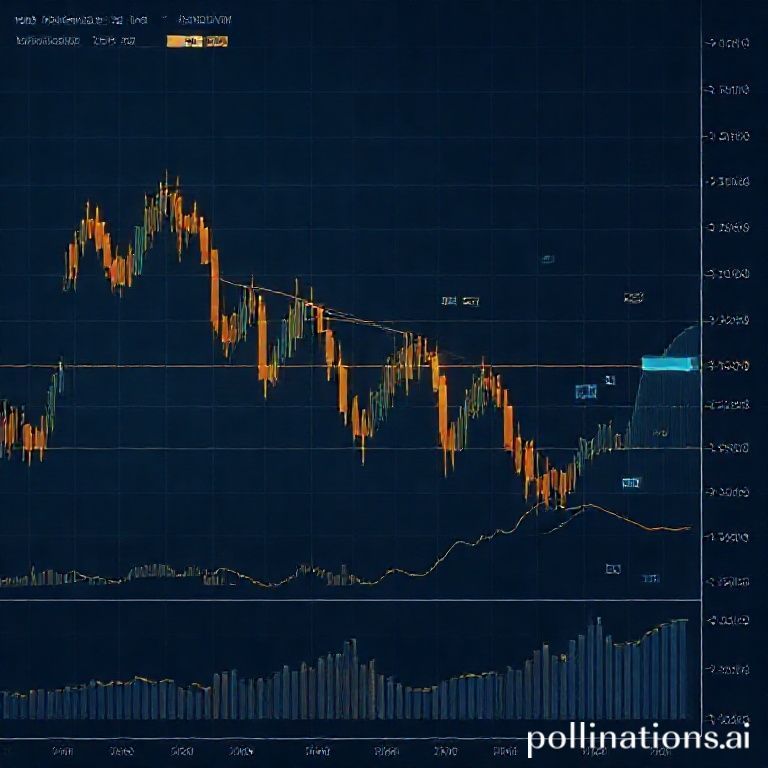

Critical Resistance Zones: Resistance often forms near multi-month consolidation highs and retracement clusters. For many major tokens, traders are watching prior cycle peaks and moving average confluence as potential rejection areas. For example, exchange sentiment reported by Company Glassnode and orderbook depth on platforms like Company Binance indicate significant sell liquidity at these resistance bands. A decisive close above those levels would signal an increased probability of trend continuation.

Crucial Support Levels: Support levels are being established at earlier accumulation zones where long-term holders have historically accepted price. These zones correspond with on-chain clustering and high-volume price nodes. Risk managers should identify these supports and set stop-losses respecting volatility. Short-term traders may use tight supports near intra-day lows, while swing traders focus on larger structural supports reinforced by long-term holder activity observed by analytics teams at Company Coinbase.

Indicators to Watch: Key indicators include on-chain metrics (net new addresses, exchange inflows/outflows), derivatives open interest, funding rates, and volume-weighted average price (VWAP) on major timeframes. A rising open interest combined with compressing funding rates often precedes explosive moves. Additionally, macro indicators—such as USD strength and sovereign yield trends—remain correlated with crypto risk appetite.

Trading Strategy Notes: Traders should adapt position sizing to liquidity conditions and avoid averaging down into structurally broken supports. Consider using a staggered entries approach: partial entries near proven support and add-on buys upon confirmed breakout above resistance. Employ clear risk-reward thresholds and monitor liquidation clusters on centralized exchanges to avoid being caught in cascading stops.

News & Catalyst Watchlist: Keep an eye on regulatory announcements, large exchange listings/delistings, and institutional custody adoption news from major custodians. Coverage by outlets like Company CoinDesk often triggers short-term volatility; similarly, on-chain analytics updates from Company Glassnode can shift sentiment rapidly.

Conclusion: The market's short-term direction hinges on whether buyers can overcome immediate resistance clusters and whether macro liquidity remains supportive. Risk-aware participants should mark the highlighted support and resistance zones, follow on-chain and derivatives indicators, and remain prepared for rapid regime shifts. For those seeking deeper insight, institutional reports and exchange orderbook analysis remain valuable complements to technical levels.

Click to trade with discounted fees